Medicare Advantage Plans

ideal for RVers and frequent travelers

We now offer several $0 Medicare Advantage PPO and MSA plans

that provide coverage in all 50 states!

2023 Annual Enrollment Opens October 15, 2022

Option 1: Medicare Advantage Choice PPO with Nationwide Coverage!

We now offer several NEW Medicare Advantage Choice PPO plans that allows you to use a very broad National Medicare Network. These plans are sold in 46 states and are also $0/mo in many areas including counties in South Dakota, Florida, and Texas.

This is a Medicare Advantage with Prescription Drugs (MAPD) and includes all of this:

- Coverage for Medicare Part A and B expenses

- Part D Prescriptions

- Dental

- Vision

- Hearing

- Fitness program

- NurseLine

These are the first MAPD plans ever that provide nationwide coverage without travel limitations; and they’re backed by the largest Medicare network in the nation.

Contact us if you want to know more about these plans and their availability in your area. We are happy to compare this option with the MSA option below and the Medicare Supplement option to help you decide which is best.Choi

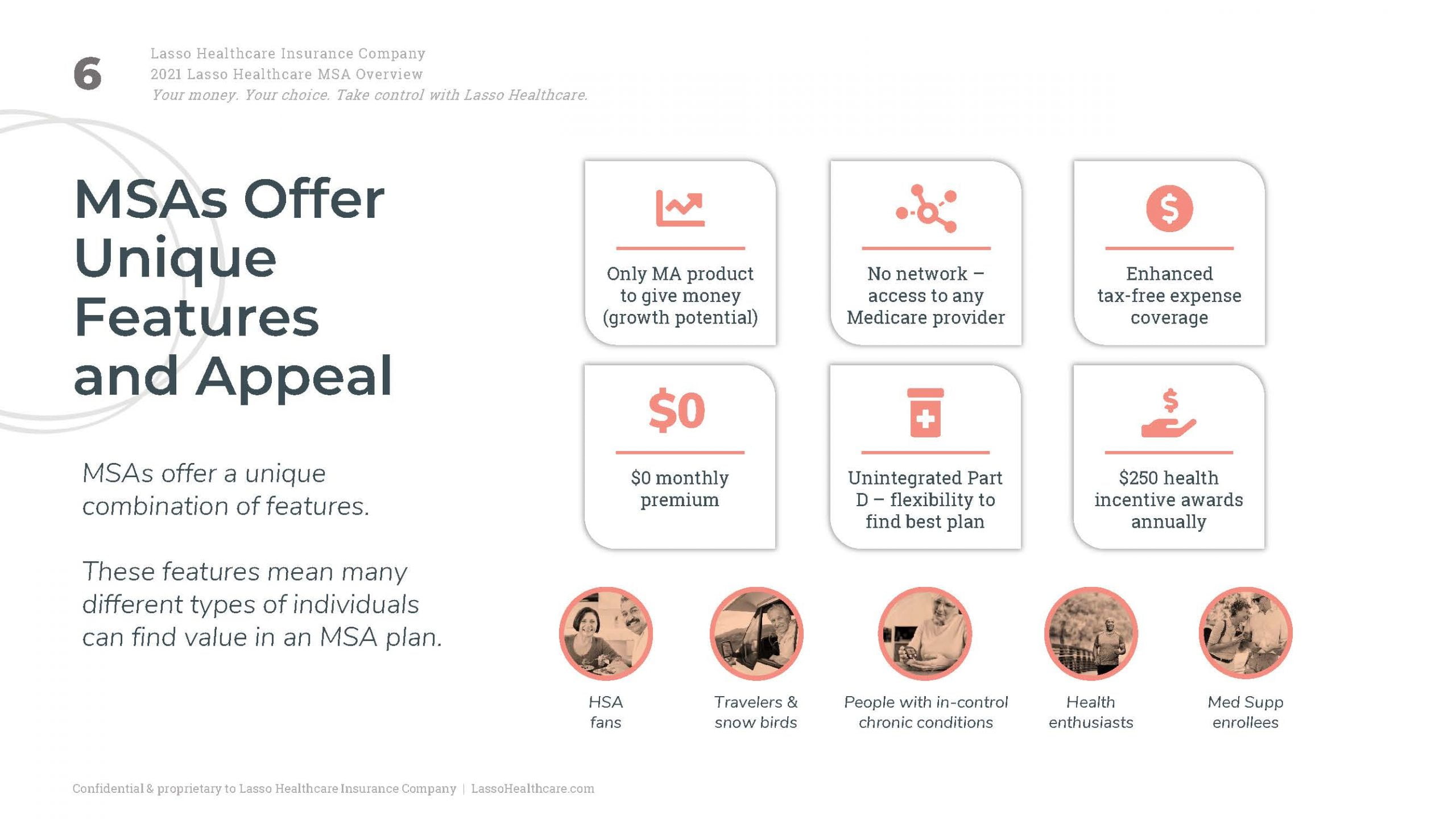

Option 2: Medicare Advantage Medical Savings Account (MSA)

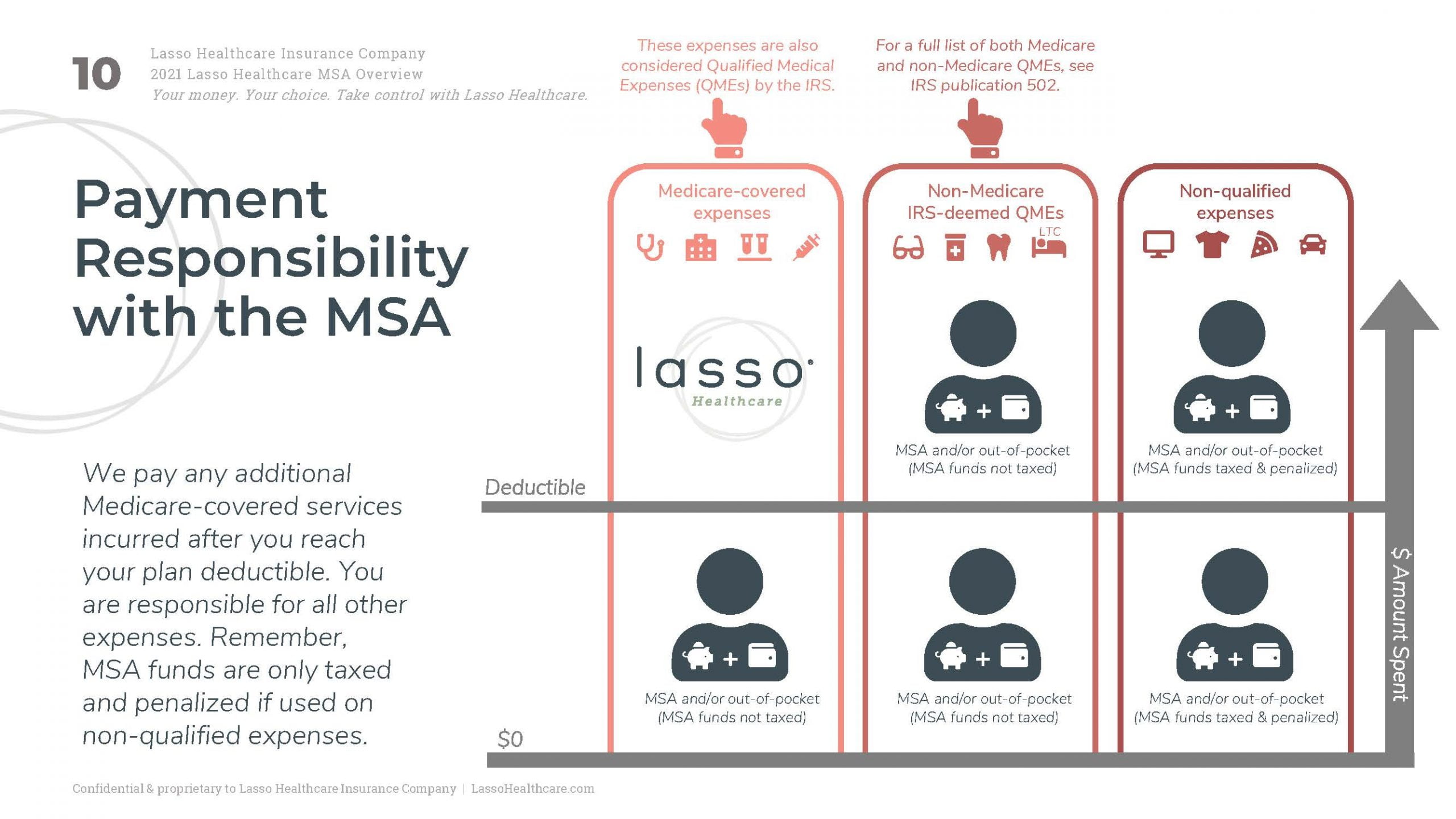

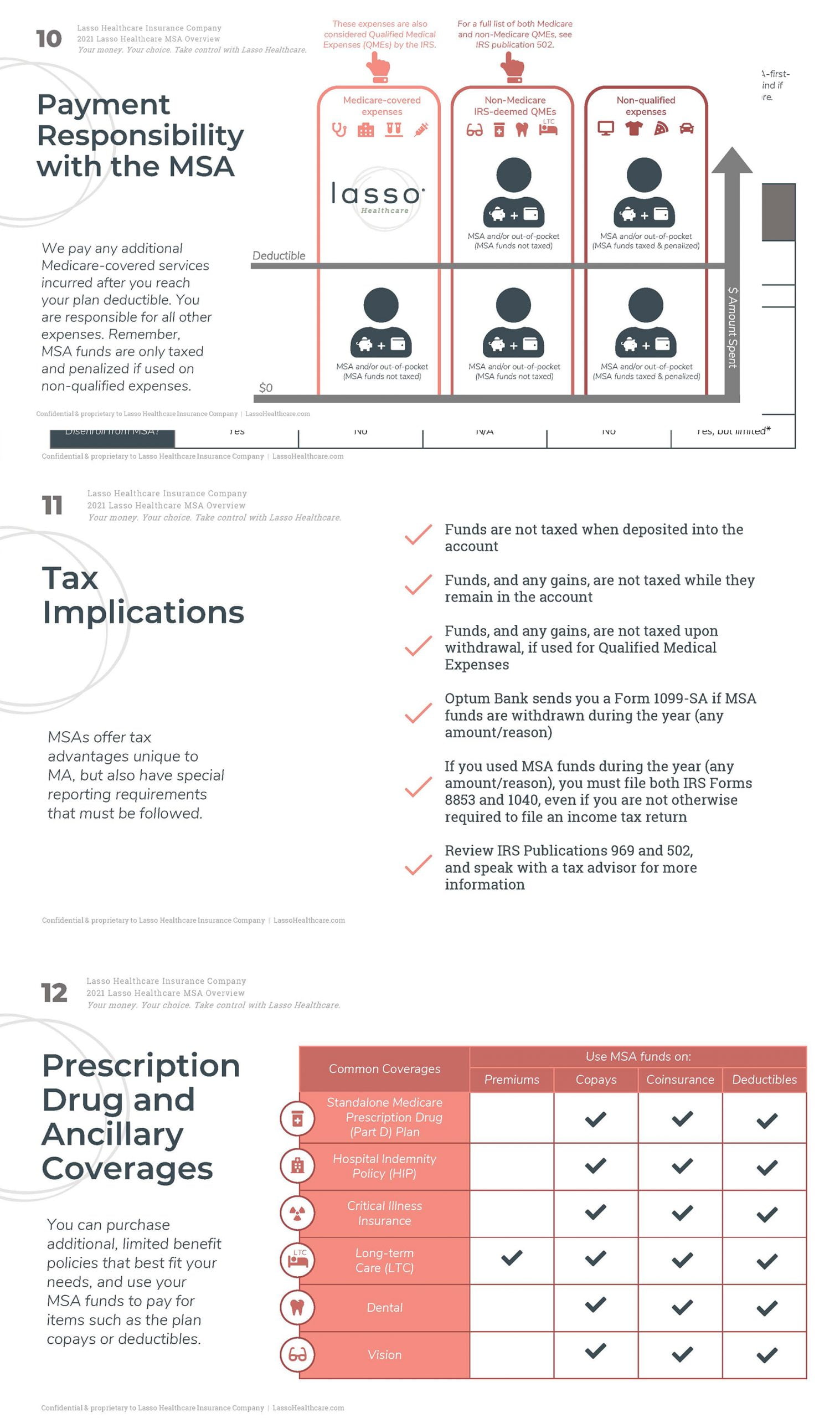

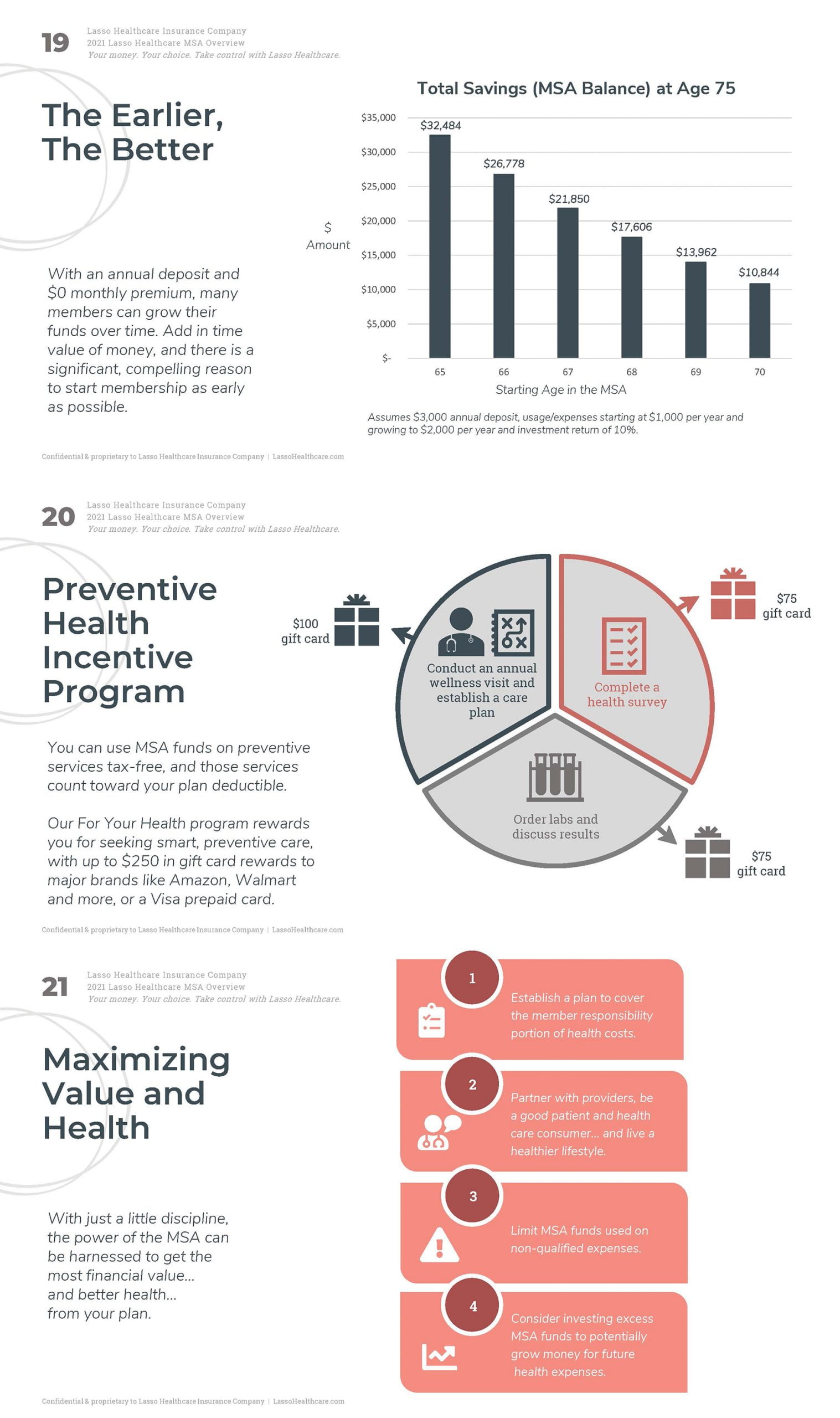

A Medicare MSA plan is a type of consumer-directed Medicare Advantage plan. An MSA plan is similar to a Health Savings Account (HSA) plan that you may have had before Medicare in that it has a Savings Account plus a High Deductible Health Plan. Unlike a Health Savings Account where the insured member funds the HSA account, with an MSA plan 100% of the funds come from Medicare.

An MSA plan is different than all other types of Medicare Advantage plans in that all Medicare-participating healthcare providers must accept your MSA plan. There are no networks with MSA plans. Nor are there any monthly premiums! By law, MSA plans can never have a premium associated with them. Continue reading below to see why we think a Medicare MSA plan is the ideal Medicare Advantage plan for Medicare-eligible RVers in the US.

Medicare MSA Plans have 2 parts

Medicare MSA Plans combine a high-deductible insurance plan with a medical savings account that you can use to pay for your health care costs.

- High-deductible health plan: The first part is a special type of high-deductible Medicare Advantage Plan (Part C) . The plan will only begin to cover your costs once you meet a high yearly deductible , which varies by plan.

- Medical Savings Account (MSA): The second part is a special type of savings account. The Medicare MSA Plan deposits money into your account. You can use money from this savings account to pay your health care costs before you meet the deductible.

October 15 to December 7, 2022

Medicare Annual Enrollment Period (AEP)

You can enroll in a Medicare Advantage plan if you have a Special Enrollment Period, are turning 65 or during AEP between October 15 and December 7, 2022 for a January 1, 2023 effective date. If you have questions and want to speak with Kyle first then please use or form and request a free consultation.

MSA Plan Introduction

One minute introduction video about Lasso's MSA planLasso Healthcare $0 Medicare Advantage MSA

Freedom and Flexibilty

An alternative to paying for an expensive Medicare Supplement plan is to enroll in a Medicare Advantage MSA plan. This plan is ideal for travelers because it allows you to see any Medicare provider in all 50 states!

Want to Discuss?

Why We Love This MSA Plan For Nomads

1. No Premium

This plan does not have a monthly premium and by law never can. You continue to pay only your Medicare Part B premium.

2. No Networks

This is the only type of Medicare Advantage plan that requires all Medicare-par providers to accept. There is no network. You have complete freedom to see any Medicare-par provider in the country.

3. No Copays

This plan has two components: A Deposit into your Medical Savings Account and a Deductible. Medicare makes the annual deposit into your account--you don't. Once you spend those Medicare-provided funds you have to meet your plan deductible and then the plan pays 100% of Medicare A and B expenses. That's it.

4. No Referrals

Unlike most other Medicare Advantage plans, you have complete flexibility and freedom without anybody else managing your healthcare other than you and your doctor.

5. No Prior Authorizations

You do not need prior authorization or permission to seek medical care. This is a choice between you and your Medicare-participating doctor.

6. No Health Questions

As long as you do not have End Stage Renal Disease you can not be turned down for this plan due to a pre-existing medical condition.

Medicare Annual Enrollment Period (AEP) Reminder

October 15 to December 7

subscribe to get updates and enrollment reminders

As of October 1, 2022 federal law now requires that anyone offering Medicare Advantage or Part D prescription drug plans to share the following disclaimer in all email communications, phone calls, and websites unless they offer every single plan available in that area, which of course we do not because we curate plans specifically suited for the nomadic community.

Nevertheless, here is the CMS required disclaimer:

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

Also as of October 1, 2022 we are required to record every phone call (inbound and outbound) with our Medicare Advantage and Part D clients. We will not do this as we feel it is a gross invasion of privacy. So all communications will unfortunately be limited to email when discussing Medicare Advantage or Part D prescription plans. We are sorry that the federal government has forced us into this approach; but we highly value personal privacy here at Nomad Insurance.

We are on a mission to show that the broker-client relationship is far more valuable for the client than ‘call-center service’ which CMS is trying to push for. We’ve heard the stories from fellow nomads who’ve called 1-800-Medicare and tried to explain to the government employee that they are a fulltime RVer and need a good Medicare plan that will cover them while on the road 3-12 months out of the year. It doesn’t go well.